Hybrid Funds

A Hybrid fund is a mutual fund that contains a stock component, a bond component and sometimes a money market component in a single portfolio. Also known as Balanced Funds or asset allocation funds. A Hybrid fund is another option for intermediate-term investors. Hybrid funds, which are often called Banlaced funds, own both stocks and bonds. They earn the "Hybrid" moniker by keeping the balance between the two asset classes pretty steady, usually placing about 60% of their assets in stocks and 40% in bonds. It aims to balance the risk-reward ratio and ensures a return. In India, the Best Hybrid Funds typically invest 50% to 70% of their portfolio in stocks and the remainder of their resources in bonds and other debt instruments.

Who should invest in Hybrid Funds?Hybrid mutual funds are for conservative investors. Hybrid mutual funds are regarded as safer bets than pure equity funds. These provide higher returns than genuine debt funds. As these are an ideal blend of equity and debt, the equity component helps to ride the equity wave. Hybrid mutual funds at the same time, the debt component of the fund provides a cushion against extreme market turbulence. In that way, you receive stable returns instead of a total burnout that might be possible in case of pure equity funds. For the less conservative category of investors, the dynamic asset allocation feature of some hybrid funds for maximum out of market fluctuations..

Benefits & features of Hybrid Funds

Because Hybrid funds rarely have to change their mix of stocks and bonds, they tend to have lower total expense ratios (ERs). Moreover, because they automatically spread an investor's money across a variety of types of stocks, they minimize the risk of selecting the wrong stocks or sectors. Finally, balanced funds allow investors to withdraw money periodically without upsetting the asset allocation.A strategical combination of debt and equity components makes the funds less vulnerable to market volatility. Equity components of the fund can generate capital appreciation, while debt components shield the investment from volatility.

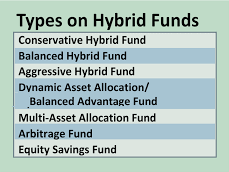

There are so many companies and so many types of Hybrid funds in market like HDFC Balanced Fund, L&T Hybrid Equity Fund, ICICI Prudential Equity & Debt Fund, SBI Equity Hybrid Fund, Canara Robeco Equity Hybrid Fund, Mirae Asset Hybrid, DSP Equity & Bond Fund, Sundaram Equity Hybrid Fund etc.

We are tracking most of major Hybrid Funds as per their Basics, Types, Benefits & features, Top performing Hybrid Fund, best Hybrid Funds investments, best Hybrid Funds in 2019. Top Hybrid Funds, How to invest in Hybrid funds, advantages and disadvantages of Hybrid funds. As per your requirement & suitable for you, we suggest right Hybrid fund to you for your child's higher education or marriage, or foreign tour or as per your any financial goals.

FOLLOW US!

Call Now