What is Mutual Fund?

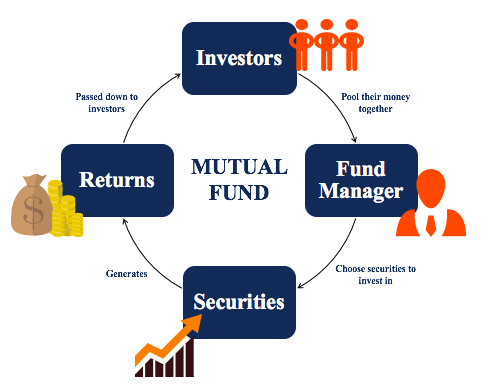

A mutual fund is professionally managed investment fund where many investors pool their money to earn returns on their capital over a period. These investors may be retail or institutional in nature. There are different types of mutual funds with their advantages and disadvantages compared to direct investing in individual securities.

Mutual Funds have emerged as one of the most popular investment choices for retail investors. The combination of good returns, ease of investing and systematic investment plans has made MFs attractive to a wide range of investors. What exactly does a Mutual Fund offer investors? And why should you invest in a Mutual Fund portfolio? Benefits of investing in Mutual Funds.

Advantages and Disadvantages of Mutual Funds

Advantages of Mutual Funds- 1. Professional Fund Manager, 2. Expert Portfolio Management,3. Risk Diversification, 4. Dividend Reinvestment, 5. Convenience and Fair Pricing, 6. Liquidity, 7. Automoted Payment, Disadvantages of Mutual Funds-1. High Expense Ratios and Sales Charges, 2. Management Abuses, 3. Poor Trade Execution, 4. Tax Inefficiency, 5. Invest in smaller denominations, 6. Lock-in-periods.

There are so many types of mutual funds in India like SIP, BALANCED FUNDS, DEBT FUNDS, EQUITY FUNDS, FIXED INCOME FUNDS, GROWTH FUNDS, HYBRID FUNDS, INCOME FUNDS, INDEX FUNDS, LIQUID FUNDS, LIQUID FUNDS, MID CAP FUNDS, MONEY MARKET FUNDS, SMALL CAP FUNDS, TAX SAVING FUNDS etc.

We are tracking most of major Mutual Fund & SIP. As per your requirement & suitable for you, we suggest right Mutual fund or SIP to you for your child's higher education or marriage, or foreign tour or as per your any financial goals.

FOLLOW US!

Call Now