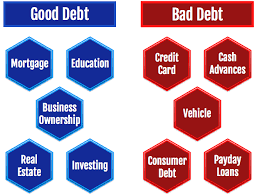

Good Loans Vs Bad Loans

Good debt or loan is low interest rate and it has the potential to increase a business or person's net worth, it's generally considered to be bad debt if you are borrowing money on very high interest rate like 24% per annum and take loan for purchase depreciating assets. In other words, if it won't go up in value or generate income, you shouldn't go into loan to buy it. While such debts usually are justifiable and bring value to the person taking on not all debt can be classified as good or bad so easily.

It is very important to learn exact difference of good debts vs bad debts. The right business loan product depends on your needs, and terms, rates and qualifications vary by lender. At the end debt free company or firm is always good for any busienss.

Types of loans

Business Loans can be categorized into two ways: Professional and Trade Loans. Working capital loan, The Receivables Exchange of India Ltd (RXIL), Term Loan- Term loan is for equipment or building or land or capital assets, Flexi Business Loan, Loan for Machinery, Loan against property, Gold Loan against jewelry or coins, Loan against shares or financial securities, Cash Credit Facility, Letter of Credit (LC), Loan against land or building, Mortgage loan. Also there are various types of loan for personal finance i.e. Home Loan, Personal Loan, Business Loan, Education Loan, Gold Loan, Vehicle/ Car Loan, Loan against Insurance Policy, Loan against PPF.

Looking for business loans? but it is very important to check best business loans for you first and then go ahead.

We have large experience to restructuring of business & personal loans, also we expert in how to handle good and bad loans.

FOLLOW US!

Call Now